People are afraid of the IRS.

Well, not everyone. Not Scientologists. When the IRS came after them, Scientology got aggressive and won. No tax.

Others are willing to move to Puerto Rico to avoid tax. The Puerto Rico Act, originally Act 20 or 22, is now Act 60 since 2019, a.k.a. Puerto Rico Incentives Code. There are tax incentives provided under Act 60 for individuals who become bona fide residents of Puerto Rico, limited to no tax.

This is a legal and valid option for those who can be outside of the U.S. for six months and a day out of the year.

But most of us just accept overpaying on taxes. We’ve taught to be conservative. To stay under the radar, avoid being audited, and accept mediocrity unnecessarily.

I get it.

There are stories of people getting in trouble, even going to jail because of evading taxes. And those who didn’t report their income, or try to become a “sovereign citizen” and stop paying taxes, yet living here in the United States, well, they eventually go to jail.

If you are taking your money offshore,

If you are abusing insurance structures (831(b)) solely to avoid tax,

If you are a profitable business, want to take income, yet pay nothing in tax,

Or you are pretending to be charitable for tax purposes (when you aren’t, Charitable LLC),

…then you may have some things to fear.

There are ethical ways to do some of these things. Others invite risk and may not be legal.

If you are claiming every dollar you make (reporting not hiding),

If you are aggressively maximizing everything within the law,

If you are truly being charitable,

If you are hiring your kids to do real work,

…then there are plenty of tax benefits available to you.

Note: If you are not a business owner, taxes are easier to manage, but you have fewer ways to reduce them. If you get a refund, you can increase your exemptions to stop letting the government borrow your money interest-free. If you have a mortgage, you may be able to deduct interest. And if you have a side hustle, any 1099 income, there is a lot more that opens up for you.

Yes, You’re Overpaying on Taxes

I once performed a survey of 117 new clients and found 107 of them were overpaying on their taxes—and many of them by tens of thousands per year.

They didn’t want to pay extra in tax, but they also didn’t want to read and understand the tax code. They didn’t have a model or framework. They weren’t sure who they needed on their tax team or if the people they were working with were maximizing their deductions.

They weren’t trained on how to navigate taxes, think about tax savings, or how to discern truth from fiction with the best ways to save. Many were only talking to their tax professional(s) once a year, and worse, often between January and April after the tax year.

You don’t need have a master’s degree or passion for tax code to keep way more of the money you make.

I am going to equip you with questions and a model to help you avoid paying more than your fair share.

Sometimes it can be hard to find the right team. There are only a select few individuals who find their passion in the world of tax and accounting. And some of those tax pros who are passionate about and the best at what they do, get so busy that things may slip through the cracks.

Maybe what makes them good at tax doesn’t translate to them being good at business. When they hire, the people working for them aren’t as good at strategy. Or they start spending less time with you, and more time hiring, firing, or trapped in their business.

It is important to know all the people required for an entrepreneur to maximize savings.

Build Your Team

If you don’t have timely data, you will overpay on taxes.

When I was nineteen and started my business, I used the shoebox method. I put my receipts in a shoe box, and on April 14th, I finally organized them all in a spreadsheet.

Embarrassing, I know. Reactive, not proactive.

Being reactive is costly. After December 31st, most of the strategies are deferrals, not credits. Sure, I can write off the expenses related to the business, but delaying eliminates most of the strategy.

I recommend meeting with your team once a quarter. This aligns with the safe harbor estimated tax payments. Are you making more or less than projected? If there is more, what strategies might help offset some of the tax burden?

If you have a small business, you can outsource and hire a part-time bookkeeper. Some people try to save the money and do this on their own, but procrastinate and cost themselves more than they save. They pay more in taxes, even though they pay less to accounting professionals.

If you are a larger organization and have payroll, you can have a full-time Controller.

Or if you have an enterprise with projects, growth, and millions in revenue, a CFO could make the most sense. This way you can have proformas, look at your margins, measure the effectiveness of your initiatives, and manage the deployment of your capital.

The key is to get organized, free up your time, and use this data to make decisions regarding your business and tax.

Next, You Need a Tax Strategist.

Let me be clear, this is not a financial historian. A historian takes what you have made, and tells you what to pay. They look back to compile the data. There is a lack of strategy and a lack of communication along the way as well.

Most people have a CPA or enrolled agent who simply prepares their taxes. This makes them reactive rather than proactive.

Instead of anticipating and strategically solving potential tax problems, such tax preparers scramble to limit tax liability after the tax year. To accomplish this, they usually tell you to dump as much money as possible into a qualified plan (SEP IRA, 401(k), etc.) or recommend other things that you otherwise wouldn’t do except to save on taxes, which creates even more problems down the road.

In contrast, a tax strategist makes tax season a non-issue by keeping you organized, creating and tracking financial benchmarks throughout the year, and limiting your tax burden.

A tax strategist is instrumental in maximizing your deductions. To classify your income, or reclassify your income, use an attorney (I’ll dedicate an entire blog to this topic). If you don’t have at least $1 million in annual revenue, hire an attorney who focuses on setting up corporations. DO NOT let your CPA give you legal advice unless they are an attorney.

The type of corporation you choose, and how you pay yourself from that corporation could impact the amount of tax you pay.

For those doing millions in revenue, consider a tax attorney. They may bring more advanced strategies that make more sense to higher-income earners.

Beware of “Conservative” Accountants

If the person filing your taxes tells you they are conservative, what does that mean? This may be a method they use to keep your business. They could be behind the times, outdated, antiquated, or using it as an excuse when you find out they missed things you could be doing to save on tax.

What do you prefer? Conservative or proactive? Conservative or aggressive within the law?

The conversation of being conservative is often the professional leveraging the fear of the unknown, the fear of the IRS.

Use Cost Segregation to Benefit from Depreciation

If you own your own building, an optional team member is a cost segregation engineer.

“Cost segregation” can make a drastic difference in deductions due to depreciation.

This effective but under-utilized accounting technique shortens the depreciation period of your assets for taxation purposes, and results in reduced tax liability and increased cash flow.

The most effective way of segregating costs and supporting these accelerated depreciation deductions is to engage an engineering firm to perform a cost segregation study.

Plan for the Future, Don’t Defer To the Future

Sometimes, tax people look like heroes today, but their strategy is a villain to your wealth later in life. Is it a deduction or a deferral? A credit or deferral?

Deduct, don’t defer.

Typical scenario: At year’s end you bring your taxes to your CPA, and one of her primary and automatic recommendations is to put money in a qualified retirement plan.

This is lazy accounting at best. If you hate paying taxes today, you are just as likely, or maybe more likely to hate paying them down the road.

And what happens if you have more money in the future, or the government raises the taxes to pay their $34 trillion in debt?

Do you plan on being more or less successful in the future? So why would it be a good strategy to save on taxes today in a way that creates a bigger tax burden tomorrow?

Of course, fee-based advisors will tell you that when you retire you can live on 70 percent or less of your pre-retirement income and that living on this percentage will lower your tax bracket.

First of all, no one knows exactly what future tax brackets will be. And with the current economic and deficit environment do you think that tax rates are going to stay at these historic lows?

Second, is this really how you want to spend your retirement years: living cheaply, afraid to spend the money you’ve earned for fear of triggering tax consequences? Do you want to have a lower standard of living when you retire?

In contrast to qualified plans, some other products and strategies provide much better exit strategies upon retirement while still offering tax benefits during the growth phase.

This doesn’t necessarily mean never contributing to a qualified retirement plan. But such a decision makes sense when part of a holistic, long-term financial plan that supports your purpose and passion, not a reactive and misguided accounting strategy based solely on numbers today.

I want to drive this point home: Paying less in tax today doesn’t mean you are saving tax.

You may pay less in tax today, but the money is not in your pocket, it is stuck in the plan. And often these plans put you at a 10 percent disadvantage from day one…if you want your money (if you are younger than 59.5 that is).

This reminds me of someone saying they saved money when buying something on sale. But was it something you were going to buy anyway? If not, you lose money, not gain it.

Temporarily delaying tax only saves you money, if:

- The government lowers taxes.

- You have more deductions in the future (at retirement your kids aren’t likely deductible anymore, even if they still live at home, lol).

- You have less money (with inflation, that isn’t a good option).

- You have an exit strategy to offset the tax.

Don’t Let the Tax Tail Wag the Dog

Would you rather pay $1 million or $10 million in tax? Most people say $1 million. My answer is $10 million because it would mean I made way more money than if I owed $1 million.

Taxes are an important consideration, but some people don’t want to produce more because they’re afraid of paying too much in taxes. They base financial decisions primarily on tax ramifications. In other words, they let the tax tail wag the dog of productivity.

Bottom line: Your first and best defense against taxes is always to earn another dollar, rather than limiting productivity and settling for a lower income in the name of saving on taxes. Even if you pay more in tax, you still have more in your pocket by earning another dollar.

NOTE: As you make more money, the higher tax rate only applies to dollars in that range. You don’t pay that rate on all your money.

The good news, any time you save tax, it is on the highest taxed dollars, the last dollar earned.

Maximize Tax Deductions

If you are a business owner, any time you spend money ask: Does this relate to my business?

Create a simple system to document your expenses. There are plenty of apps available, or you can use a credit card to track many of your expenses.

If you aren’t sure if the expense can be deducted, mark it for your quarterly meeting with your tax team and ask.

At these quarterly meetings, proactively ask questions. This is a time to brainstorm. There are no consequences to brainstorming, you aren’t going to be implementing every idea you come up with. Are there any tax law changes or new strategies they have discovered?

I like to find out the best strategy the tax team has implemented for any of their other clients in the last 90 days. Could this apply to me? Go through your expenses and ask if any other business has been able to write that expense off and why.

Some things you can write off a portion of it. Is it used for business part of the time?

Increase Your Deductions with Confidence

People often want a clearly defined, bullet-point list that spells out legitimate deductions explicitly.

Section 162 of the IRS tax code simply states that you can deduct all “ordinary and necessary” business expenses. This means you can and should be deducting far more expenses than you currently are.

Deduct anything and everything connected with your business, while making sure you can build the case to support the connection.

To make it practical, here are some deductions to consider:

- Home Office: what percentage of your home is used as office space? Apply that percentage to utilities, house payments, etc.

- 132(j): Do you have a pool and/or gym? If you give employees access to it, then you can write off the maintenance. I have a company that is only my wife and I, easy to give us access. We also hired our kids, great to give them access as well.

- Augusta Rule: You can rent your house out to your business for up to 14 days a year. This is tax-deductible to the business, but you do not have to claim the income personally. I filmed a course at my house, hosted a two-day workshop, and had retreats.

- Pay Your Kids: Just over 13,000 a year can be tax free. This can be fully tax-deductible to you as well. Caveat: You must have them actually do the work.

- Corporate Retreats: You can travel and write off some or all of your trip.

- Section 179 of the IRS tax code allows you to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. The full purchase (or lease) price of qualifying equipment can be deducted from your gross income. It’s the government’s way of incentivizing businesses to invest in themselves.

- 199a/QBI is a provision in the U.S. tax code that allows certain business owners to deduct up to 20 percent of their qualified business income from their taxable income. This deduction was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017.

Conclusion

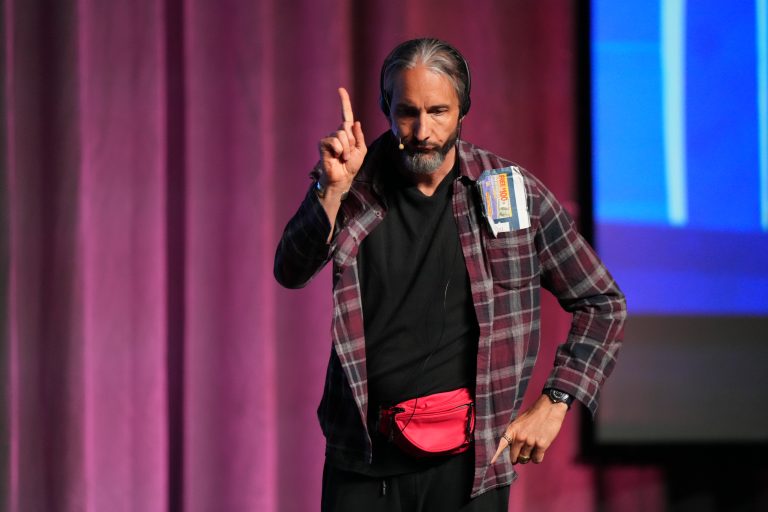

If you want to design your financial team, if you want support in saving money, keeping more of what you make, and enjoying life more along the way, click here to book a one-on-one with me at my Cash Cabin.

I like to keep connected as I am creating content. To see the results and take my quarter of a century of knowledge and building relationships to get you the results you deserve.

You work hard for your money, and you deserve to keep as much of it as possible.

Put your taxes in their proper context and never let the tax tail wag the dog of productivity. And make sure you have the right tax strategist to safely and legally reduce your tax burden to the bare minimum.

I’m here to help!

Ready to Stop Guessing With Your Money?

Most financial advice tells you to save more and spend less. That’s a losing game. Garrett’s free book Killing Sacred Cows reveals why the conventional wisdom is costing you—and what to do instead.

Do it yourself? Try the free Relationship Currency tool on X1 Wealth.

Frequently Asked Questions

What is the Puerto Rico tax incentive Act 60?

Act 60 offers massive tax incentives for individuals who become bona fide residents of Puerto Rico — potentially zero tax on certain income. You must be outside the U.S. for six months and a day per year to qualify.

How did Scientology beat the IRS?

They fought back aggressively when the IRS came after them and won tax-exempt status. Most people don’t fight — they just accept overpaying out of fear.

Am I overpaying on my taxes?

Most people are. If you’re not using entity structures, strategic deductions, cost segregation, or other legal strategies, you’re likely leaving thousands on the table every year.

Should I move to Puerto Rico to avoid taxes?

Only if it aligns with your lifestyle and business. It’s a powerful legal strategy, but you need to actually live there half the year — don’t just chase the tax break if it ruins your quality of life.

4 thoughts on “Stop Tipping the Government”

I 100% Agree with Garrett! There is a significant difference between a tax preparer and a tax strategist. If you are making a good income you need BOTH! A key to successful tax planning is once you mitigate your taxes make sure you use those savings to improve your legacy through the proper savings and growth philosophies that will ensure the money you save is put to work for you. Take control through proper utilization of the tax incentives congress has put in place. Thanks for your leadership Garrett!

Roger, good to see you reading and commenting. You see the impact of both all the time!

Do you have a network of tax strategists that think like you? Thank you.

Yes I do, several companies. Best way to discover your options and build out a plan is GarrettGunderson.com/discovery