“If It’s Worth Doing, It’s Worth Doing Right”…

My dad said that to me more times than I can count.

At first it sounded like a rule. Later it became a rhythm. Now it feels like a reminder.

A reminder that our life reflects the standards we set or accept.

A reminder that shortcuts cost more than doing something right the first time.

A reminder that money is a representation of our attention, not just our effort.

Financially, most people try to make progress while tolerating things that hold them back.

Slow leaks. Small fears. Old stories. Half-finished conversations with themselves.

The problem is not their capability. It’s a half-assed idea, rather than a dream or a plan.

(Half-assed, another word/phrase my dad used when something wasn’t done well).

What Do You Want: Eventually or Now?

Do you want financial independence sometime down the road, or do you want the confidence to live that way today?

Do you want a convenient team or a comprehensive and coordinated one?

Do you want a life where you react to money or a life where money supports the life you choose?

These questions matter.

They reveal where you’re playing small.

They reveal the gap between your potential and your permission to prosper.

Back in 2008 I took an assessment giving me the awareness of just how mediocre my health and my marriage had become.

Eating too much, not working out enough.

Working too much, putting my marriage in the distance.

There was no vision, no reading, no coaches, no money invested to raise the bar in these areas.

But with this awareness, I was able to change. I was able to adjust. I was able to grow.

By hiring a trainer and hiring a marriage coach, these two areas were transformed.

Tolerance Is Expensive

The things not working in your financial life are rarely loud. They are subtle. Easy to excuse. Easy to explain away. Easy to push to the back of the drawer.

But money doesn’t respond to excuses. It responds to alignment.

You create wealth by being valuable, not by being tolerant.

You expand wealth by being free enough to act, not by being afraid of what might go wrong.

When people feel stuck financially, it’s often because something in the background is weighing them down.

A blind spot. A story. A fear of being judged if someone saw the numbers. A fear of confronting what they believe they “should” have figured out by now.

What Are You Delaying?

Think about the thing you’ve been putting off.

- The conversation with a financial professional.

- The decision to get coordinated.

- The choice to look honestly at your statements.

- The questions about your insurance, estate plan, liabilities, opportunity costs.

- Firing someone who you have outgrown (avoiding confrontation, but costing you cash)

Your past creates an almost predictable limited future.

What have you experienced that was less than ideal?

Is the delay because it feels like a hassle?

Because you had an advisor in the past who talked over you?

Because you worry someone will lock your money away, push unnecessary risk, or speak in jargon that leaves you feeling confused?

I get it. I’ve been there. And here’s the truth:

People delay because they want to protect something

… their peace

… their image

… their sense of control

… or the illusion that everything is fine.

Their reputation even.

Over a decade ago I finished a speech, when a young man rushed up to me and asked if I was a billionaire.

No. Not even close.

But just because I had a New York Times Bestselling book and was on stage, it positioned me in his mind as much bigger than I was. I’ve met 23 billionaires, and I have also met a dozen people that lied about being billionaires.

One offered up the fake number, and the other group was quiet about it.

The moral to this story is that “fake it until you make it” will do more harm than good.

If you have to hold up appearances or lie, it will be noticed. It will be felt.

By most you talk to, but especially yourself.

The road to progress is to be honest.

Open up to people where there is a safe space to be vulnerable, and you will breakthrough and grow. More support, less stress.

What Would Life Feel Like If You Were Financially Fit?

Imagine knowing your financial house was in order.

Imagine having the structure to handle downturns, recessions, surprises, and seasons of chaos.

Imagine clarity instead of clutter.

Imagine daily freedom instead of daily worry.

And imagine designing what you want without feeling judged, rushed, or “behind”.

If you could create your financial life from scratch, what would you want first?

- Cash flow from assets?

- A peace of mind fund?

- A coordinated team?

- Or simply more space to breathe?

Most people never give themselves permission to answer theses question. They assume what they want is unrealistic or that someone else must approve it. That’s the quickest way to shrink your vision.

Maybe the advice you get has more to do with the compensation of the advisor than your own dreams.

The Cheshire Cat Method

If you are unclear about what you want, any road will take you somewhere.

But maybe not somewhere you enjoy.

Most roads lead to AUM (assets under management).

Locking your money in a retirement plan.

They don’t usually include cash flow, liquidity, or focusing on quality of life along the way.

If you don’t have a plan, an advisor will sell you one. Likely theirs.

But is it what you want?

Wandering is expensive. Guessing is costly.

Avoiding the truth slows down your money and your luck.

Clarity is not about being perfect. It’s about being honest.

What Story Is Running Your Money?

This is the part most people skip.

The emotional side.

The slow part.

The part where you admit what you are carrying.

- Guilt.

- Shame.

- Embarrassment.

- Uncertainty.

- Comparison.

And here’s the surprise: even the people who look the most successful carry these same stories. They hide it well, but it’s there.

I’ve made financial mistakes after writing entire books about how to avoid financial mistakes.

Painful. Hard to admit.

I should have known better, I thought. How could I have made this mistake?

But that’s part of being human. It’s how we learn. Often, it’s the tuition we pay for wisdom.

Oh yeah, I’ve made a ton of mistakes. Too many to count, such as:

- Having too many businesses in my 20s.

- Being over leveraged in real estate.

- Neglecting my health and family.

- Choosing the wrong business partner, not once, but twice in my 30s.

- Selling my business for less than I could/should have in my 40s.

- Doing an NFT with Steve Aoki the DJ, where he completely reversed what he said, and the money was gone with one click of an email. Damn. That was in 2024.

But I’ve done also plenty right.

- Setting up a Family Constitution.

- Writing 10 books.

- Loving what I do and setting up a business that is fulfilling and valuable.

Yeah, I made some money on some real estate and owning small pieces of companies… more good than bad, but it’s all part of the process.

Pretending Is Protection, But It Is Also Heavy

People pretend to protect their ego, their reputation, the version of themselves they have crafted in their mind.

But the pretending becomes weight. It slows your step. It clouds your creativity.

So ask yourself:

What would you have to let go of to feel financially light?

What belief would you have to release?

What story would you have to rewrite?

What action would you take if you trusted your vision instead of your fear?

Courage Over Convenience

This is the foundation.

This is the work.

This is what doing it right looks like.

Not forcing it.

Not rushing it.

Not outsourcing your responsibility.

Not surrendering your peace of mind.

This is about choosing yourself.

Your family.

Your quality of life.

Your legacy.

As Dad said, if it’s worth doing, it is worth doing right.

And you are worth doing it right for.

Want to Accelerate Your Journey to True Wealth?

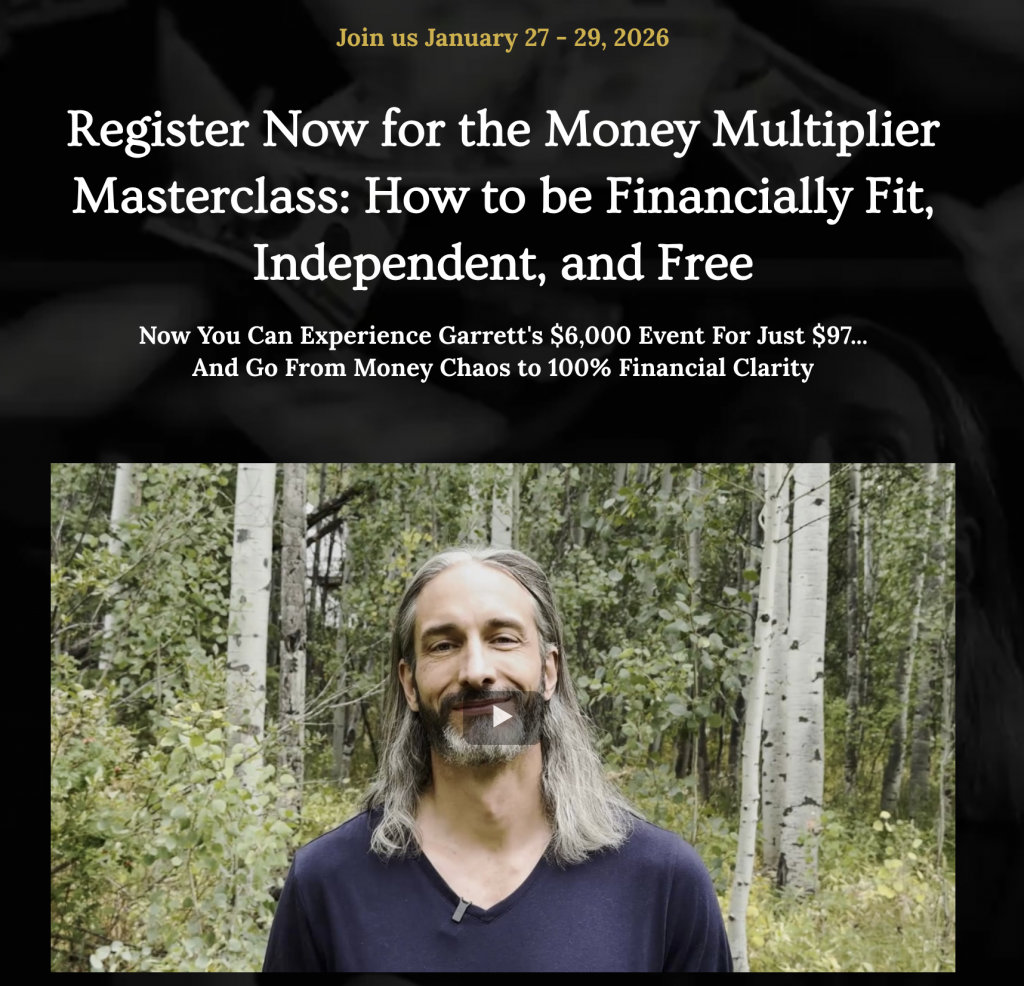

Our last Masterclass was a hit. We got amazing feedback. I had a blast sharing my message with passion. And we even built a fun, collaborative community with VIP members in a private WhatsApp group.

Tickets are on sale now for just $97 and we’re going to help you go from money chaos to financial clarity.

Thanks for reading, and hope to see you there.